Last Thursday (12 November), HM Revenue & Customs published draft legislation for the plastic packaging tax, alongside a summary of responses to the recent consultation.

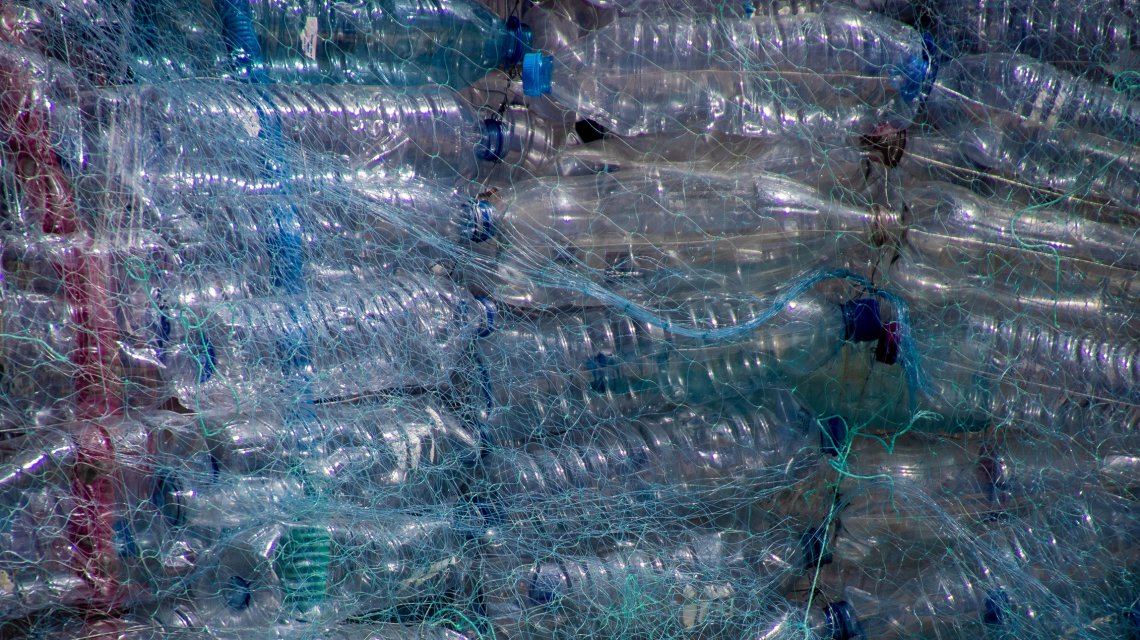

The plastic packaging tax will apply to producers of packaging which is predominantly plastic by weight and does not contain at least 30% recycled plastic, whether imported or manufactured in the UK.

The tax aims to significantly increase the use of recycled content in plastic packaging, while driving recycling technologies here in the UK and helping to divert plastic from landfill or incineration.

At the Budget 2018, it was announced by Government that a plastic packaging tax would be introduced in April 2022 to increase demand and encourage the use of recycled plastic content. Since the announcement we have seen a call for evidence and two rounds of consultations.

It was declared at the Budget 2020 that the tax will be £200 per tonne of plastic packaging which does not meet the 30% recycled content threshold. It was also confirmed that once the tax is introduced the rate and recycled content threshold will be kept under review to ensure the tax remains effective in increasing the use of recycled plastic.

You can view the summary of responses for the most recent Policy Design consultation here.

Inclusions, Definitions & Clarifying the Tax Point

It has been revealed that imported pre-filled goods will be included in the tax, as will packaging-type products and long-term storage containers, e.g. cling film and storage containers such as large plastic boxes.

Government recognised concerns and mixed views from respondents regarding the revised definition of plastic which removed the ‘main structural component’ clause and limiting exclusions to ‘cellulose-based’, nevertheless they will continue with the revisions. Thus, confirming alternative plastic such as biodegradable and compostable plastics are liable for taxation for now since further evidence is needed on the impact of widespread adoption of these materials. However, they will further consider these plastics following conclusion of the Bioeconomy Strategy.

Government confirmed that ‘the tax will be applied to domestically produced goods at final stage conversion on finished plastic packaging components’. Although many agreed, concerns were raised regarding anti-competitiveness to UK businesses since plastic waste from ancillary processes would be taxed whereas the same imported packaging would not be. Therefore, the Government has agreed the tax point should arise ‘at the final stage of conversion, after ancillary processing, but before the packaging is packed or filled’. Going on to state a continued encouragement for businesses to ‘take all steps they can to reduce the amount of waste created by their manufacturing processes more widely’.

De Minimis & Exemptions

The de minimis has been confirmed so businesses that manufacture and/or import less than 10 tonnes of plastic packaging in a 12-month period will be exempt from the tax.

Other exemptions include plastic packaging which:has 30% or more recycled plastic content;

- is made of multiple materials of which plastic is not proportionately the heaviest when measured by weight;

- is manufactured or imported for use as immediate packaging of licensed human medicines;

- is in use as transport packaging to import products into the UK; or

- is exported, filled or unfilled, unless it is in use as transport packaging to export products out of the UK.

You can view the policy paper and draft legislation online here.

HMRC stated that “The tax will provide a clear economic incentive for businesses to use recycled material in plastic packaging, which will create greater demand for this material and in turn stimulate increased levels of recycling and collection of plastic waste, diverting it away from landfill or incineration.”

If you have any questions as to how the plastic packaging tax may impact your business please contact our team.